Final expense insurance serves as a safety net for families during challenging times. As the name suggests, it covers the expenses associated with one’s final arrangements, offering financial relief to loved ones left behind.

Understanding Final Expense Insurance

What is Final Expense Insurance?

Final expense insurance, also known as burial insurance or funeral insurance, is a type of life insurance designed to cover end-of-life expenses. It provides a lump sum payment to beneficiaries upon the policyholder’s death, which can be used to cover funeral costs, medical bills, and other outstanding debts.

Why is it Important?

Final expense insurance ensures that your loved ones are not burdened with the financial responsibilities associated with your passing. It provides peace of mind knowing that they will have the necessary funds to honor your memory without experiencing financial strain.

Types of Final Expense Insurance

There are several types of final expense insurance policies available, each catering to different needs and preferences.

Whole Life Insurance

Whole life insurance offers permanent coverage with fixed premiums and a guaranteed death benefit. It accumulates cash value over time, providing an additional source of savings.

Burial Insurance

Burial insurance is specifically designed to cover funeral and burial expenses. It is a type of whole life insurance with lower coverage amounts and simplified underwriting requirements.

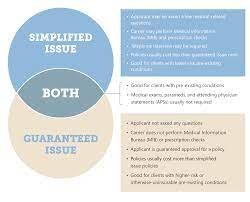

Simplified Issue Insurance

Simplified issue insurance does not require a medical exam for approval. It offers quicker coverage for individuals who may have pre-existing health conditions or difficulty qualifying for traditional life insurance.

Eligibility and Application Process

Age Requirements

Final expense insurance is typically available to individuals between the ages of 50 and 85, although some insurers may offer coverage to younger applicants.

Health Considerations

While final expense insurance does not require a medical exam, insurers may ask health-related questions to assess risk. Certain pre-existing conditions may impact eligibility or result in higher premiums.

Application Process

The application process for final expense insurance is relatively straightforward. Applicants provide basic personal information and answer health-related questions. Once approved, coverage begins, and premiums are paid on a regular basis.

Coverage and Benefits

Funeral Expenses

Final expense insurance covers various funeral expenses, including caskets, burial plots, memorial services, and cremation costs.

Medical Bills

In addition to funeral expenses, the death benefit can be used to cover outstanding medical bills and other end-of-life healthcare expenses.

Outstanding Debts

Final expense insurance can help settle outstanding debts, such as credit card balances, loans, and mortgage payments, ensuring that your loved ones are not left with financial obligations.

Costs and Premiums

Factors Affecting Premiums

Premiums for final expense insurance are based on several factors, including age, gender, health status, coverage amount, and smoking status.

Cost Comparison

It’s essential to compare quotes from different insurers to find a policy that offers adequate coverage at an affordable price.

Advantages of Final Expense Insurance

Financial Protection for Loved Ones

Final expense insurance provides financial security for your loved ones, allowing them to focus on grieving and healing without worrying about financial burdens.

Peace of Mind

Knowing that your final expenses are taken care of brings peace of mind during uncertain times. It ensures that your wishes are honored and your legacy is preserved.

Disadvantages and Considerations

Limited Coverage

Final expense insurance typically offers lower coverage amounts compared to traditional life insurance policies, which may not be sufficient for certain financial obligations.

Higher Premiums

Since final expense insurance is designed for older individuals and those with health issues, premiums tend to be higher than term life insurance policies.

Health Restrictions

Individuals with significant health issues may face limitations or exclusions when applying for final expense insurance, making it essential to explore all options carefully.

How to Choose the Right Policy

Assessing Individual Needs

Consider your financial situation, end-of-life preferences, and the needs of your beneficiaries when selecting a final expense insurance policy.

Comparing Quotes

Obtain quotes from multiple insurers to compare coverage options, premiums, and policy features. Choose a policy that aligns with your budget and provides adequate protection for your loved ones.

Conclusion

Final expense insurance offers a practical solution for covering end-of-life expenses and providing financial security for loved ones. By understanding the types of coverage available, eligibility requirements, and the application process, individuals can make informed decisions to protect their families during challenging times.

Frequently Asked Questions (FAQs)

- What is the difference between final expense insurance and life insurance? Final expense insurance is specifically designed to cover end-of-life expenses, such as funeral and burial costs, while life insurance provides broader coverage for financial protection.

- Can I purchase final expense insurance for someone else? Yes, you can purchase final expense insurance for someone else, such as a parent or family member, as long as you have insurable interest and their consent.

- Will final expense insurance cover cremation expenses? Yes, final expense insurance can be used to cover cremation expenses, including crematory fees, urns, and memorial services.

- Are there any medical exams required for final expense insurance? While some final expense insurance policies may require a medical exam, many offer simplified underwriting with no medical exams required.

- Can I customize my final expense insurance policy? Yes, many insurers offer flexible options to customize final expense insurance policies based on individual needs and preferences.