In an era where health is wealth, having a robust healthcare plan is paramount. Private health insurance has emerged as a vital tool to ensure individuals and families have access to top-notch medical care without breaking the bank. In this detailed guide, we’ll explore the ins and outs of private health insurance, shedding light on its importance, benefits, considerations, and how to choose the right plan for your needs.

Understanding Private Health Insurance

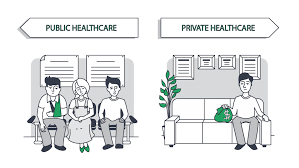

Private health insurance is a type of coverage that individuals purchase directly from insurance providers to supplement or replace the coverage offered by government-sponsored health plans. Unlike public health systems, private health insurance allows for a more personalized and often faster access to medical services.

Importance of Private Health Insurance

- Tailored Coverage Options

- Private health insurance offers a range of coverage options, allowing individuals to choose plans that align with their specific healthcare needs. This customization ensures that you pay for what you truly require.

- Prompt Access to Medical Services

- Private health insurance often provides quicker access to medical services, including specialist consultations, diagnostic tests, and elective procedures. This timely access can be crucial in managing and treating health conditions effectively.

- Choice of Healthcare Providers

- With private health insurance, you have the flexibility to choose your healthcare providers, including doctors, hospitals, and clinics. This freedom of choice empowers individuals to receive care from trusted and preferred professionals.

- Additional Benefits and Services

- Many private health insurance plans come with additional benefits, such as coverage for dental care, vision services, mental health support, and wellness programs. These extras enhance the overall value of the insurance policy.

Types of Private Health Insurance Plans

Understanding the various types of private health insurance plans is key to making an informed decision about your healthcare coverage.

1. Health Maintenance Organization (HMO)

HMO plans require members to choose a primary care physician (PCP) and obtain referrals from the PCP to see specialists. These plans often have lower out-of-pocket costs but limited flexibility in choosing healthcare providers.

2. Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers and do not require referrals to see specialists. However, out-of-pocket costs may be higher compared to HMO plans.

3. Exclusive Provider Organization (EPO)

EPO plans combine features of HMO and PPO plans. Members have a designated network of healthcare providers but can also seek care outside the network at a higher cost.

4. Point of Service (POS)

POS plans combine features of HMO and PPO plans, allowing members to choose a primary care physician and obtain referrals for specialists. Seeking care outside the network is possible but may come with higher costs.

Factors to Consider When Choosing Private Health Insurance

- Coverage and Benefits

- Assess the coverage options and additional benefits offered by each plan. Consider your current healthcare needs and any potential future requirements.

- Network of Healthcare Providers

- Check the network of healthcare providers associated with each plan. Ensure that your preferred doctors, specialists, and hospitals are part of the network.

- Out-of-Pocket Costs

- Evaluate the out-of-pocket costs, including deductibles, copayments, and coinsurance. A plan with lower premiums may have higher out-of-pocket costs, and vice versa.

- Prescription Medication Coverage

- If you require prescription medications, review the coverage for prescription drugs. Ensure that the plan covers the medications you currently take or may need in the future.

- Policy Exclusions and Limitations

- Carefully read and understand the policy exclusions and limitations. Be aware of any specific conditions or treatments that may not be covered by the insurance plan.

- Customer Reviews and Reputation

- Research the customer reviews and reputation of the insurance provider. A reputable and customer-friendly provider can make a significant difference in your overall healthcare experience.

The Process of Obtaining Private Health Insurance

- Research and Comparison

- Begin by researching different private health insurance plans. Utilize online comparison tools, read reviews, and gather information on the coverage and benefits offered by various providers.

- Application Process

- Once you’ve identified a suitable plan, proceed with the application process. Provide accurate and complete information about your health history and any pre-existing conditions.

- Underwriting and Approval

- The insurance provider will assess your application through underwriting, considering factors like your age, health status, and medical history. Upon approval, you will receive your policy details.

- Payment of Premiums

- Pay the required premiums according to the payment schedule outlined in your policy. Timely payment is crucial to maintaining continuous coverage.

- Accessing Healthcare Services

- After obtaining private health insurance, you can start utilizing the services covered by your plan. Schedule appointments, undergo tests, and seek medical care as needed.

Common Misconceptions about Private Health Insurance

- Private Health Insurance is Only for the Wealthy

- Contrary to popular belief, private health insurance plans come in various price ranges, making them accessible to a wide range of individuals and families.

- Public Health Systems Are Always Sufficient

- While public health systems provide essential services, they may have limitations, including longer wait times for certain procedures. Private health insurance offers an alternative for those seeking more immediate and personalized care.

Conclusion

In conclusion, private health insurance is a valuable investment in your well-being, providing tailored coverage, prompt access to medical services, and a choice of healthcare providers. Understanding the types of plans available, factors to consider when choosing, and the application process empowers individuals to make informed decisions about their healthcare coverage.

FAQs

- Can I purchase private health insurance at any time?

- In many cases, you can purchase private health insurance at any time, though there may be open enrollment periods. Certain life events, such as getting married or having a child, may also qualify you for a special enrollment period.

- Do private health insurance plans cover pre-existing conditions?

- Many private health insurance plans cover pre-existing conditions, but the specifics can vary. It’s essential to review each plan’s policy regarding pre-existing conditions before choosing.

- Can I have both private health insurance and a public health plan?

- Yes, it is possible to have both private health insurance and a public health plan. This arrangement, known as dual coverage, can provide comprehensive healthcare coverage.

- Are wellness programs included in private health insurance plans?

- Some private health insurance plans offer wellness programs as an additional benefit. These programs may include preventive services, fitness incentives, and resources for maintaining a healthy lifestyle.

- How often can I change my private health insurance plan?

- The ability to change your private health insurance plan may depend on factors such as your enrollment status and any qualifying life events. Check with your insurance provider for specific details on plan changes.