National debt, an enigma often discussed in hushed tones within economic circles, has the power to shape nations’ destinies. As we embark on the journey to understand this intricate concept, we’ll navigate through its definition, historical context, current scenarios, and global implications.

Understanding National Debt

Definition and Basics

At its core, national debt refers to the total amount of money a government owes to external creditors and its citizens. This financial construct arises from government borrowing, often to fund critical initiatives such as infrastructure development, social programs, and responses to economic crises. To grasp its implications fully, let’s explore the fundamental aspects of national debt.

Factors Influencing National Debt

Government Spending

A significant contributor to national debt is government spending. As funds are allocated to diverse projects and initiatives, borrowing becomes a necessity, directly influencing the overall debt level.

Taxation

The delicate balance between government revenue and expenditure plays a crucial role in national debt dynamics. Taxation policies directly impact the funds available to the government, affecting its reliance on borrowing.

Economic Conditions

The state of the economy, influenced by factors like inflation, unemployment, and GDP growth, is another key determinant of national debt levels.

Historical Overview

Evolution of National Debt

The historical journey of national debt is a compelling narrative reflecting a nation’s economic evolution. From early borrowings to fund wars to the establishment of modern economic systems, this evolution is a testament to changing times.

Key Moments in National Debt History

Major Economic Crises

Economic crises have historically led to a surge in national debt as governments implement stimulus packages to counter downturns.

Wars and National Debt

Wars have consistently been a catalyst for increased national debt, with nations borrowing extensively to finance military operations.

Current National Debt Scenario

Latest Figures and Statistics

Examining current national debt figures provides insights into a country’s economic health. Analyzing recent statistics and comparing them with previous years helps to comprehend the financial landscape.

Comparison with Previous Years

Factors Contributing to Debt Increase

Identifying the factors contributing to the rise in national debt is crucial for assessing economic policies and external influences impacting a country’s finances.

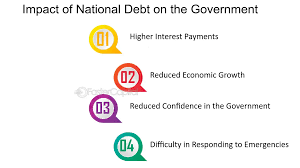

Impact on the Economy

The consequences of high national debt on the economy can be multifaceted, affecting interest rates, inflation, and overall economic stability.

Pros and Cons of National Debt

Advantages

Stimulating Economic Growth

Strategically incurred national debt can act as a catalyst for economic growth, providing necessary funds for development projects.

Financing Important Projects

National debt can be a valuable tool for financing crucial infrastructure projects and social programs, contributing to long-term societal benefits.

Disadvantages

Burden on Future Generations

High national debt places a burden on future generations, as repaying the debt becomes a responsibility inherited by the next wave of citizens.

Risks of High Debt Levels

Elevated national debt levels pose risks, including the potential inability to respond adequately to economic downturns and limited fiscal maneuverability.

Managing National Debt

Government Policies

Governments employ various strategies to manage national debt, including debt reduction initiatives and fiscal policies aimed at maintaining a sustainable balance between revenue and expenditure.

Debt Reduction Strategies

Implementing effective debt reduction strategies involves a combination of budgetary discipline, economic reforms, and prudent financial management.

Fiscal Policies

Adopting sound fiscal policies, such as maintaining a balanced budget and implementing measures to boost revenue, is essential for managing national debt effectively.

Global Perspectives on National Debt

A Comparative Analysis

Comparing national debt levels across different countries provides valuable insights into the diverse approaches governments take in managing their finances.

International Implications

The interconnectedness of the global economy means that the national debt of one country can have ripple effects on others. Understanding these international implications is crucial for policymakers.

Addressing Concerns and Myths

Common Misconceptions

Is National Debt Always Bad?

Contrary to popular belief, national debt is not inherently bad. When managed responsibly, it can be a strategic tool for economic growth and development.

Can a Country Be Debt-Free?

Achieving complete freedom from debt may not be practical or desirable for every nation. Responsible debt management is often more realistic than complete debt elimination.

Future Outlook and Predictions

Economic Forecasts

Examining economic forecasts provides insights into the trajectory of national debt, helping policymakers make informed decisions for a sustainable future.

Strategies for a Sustainable Future

Developing and implementing strategies for sustainable debt management is crucial for securing a stable economic future for a nation.

Conclusion

In the intricate tapestry of national debt, understanding its nuances is essential. It is neither a villain nor a hero but a dynamic force that, when harnessed wisely, can propel a nation towards prosperity. As governments navigate the complexities of economic management, striking a balance between borrowing and fiscal responsibility remains paramount.

FAQs

- Is national debt always a negative factor for a country’s economy?

- National debt’s impact varies; while excessive debt can be detrimental, moderate levels can spur economic growth.

- How does national debt affect interest rates?

- High national debt may lead to higher interest rates, influencing borrowing costs for both the government and private sector.

- Can a country be completely debt-free?

- Achieving complete debt elimination is challenging; responsible debt management is a more practical goal for most nations.

- What role does inflation play in national debt dynamics?

- Inflation can erode the real value of debt, providing relief to countries with moderate inflation levels.

- How do global economic conditions impact a nation’s national debt?

- Global economic conditions, such as recessions or financial crises, can indirectly affect national debt through trade and financial interconnectedness.